Asset-Based Lending Audits: The Ultimate Guide for Business Owners

Jul 8, 2025, 5 Minute(s) ReadLearn how ABL audits work, how to prepare, and how to leverage them to unlock growth capital, optimize operations, and build lender confidence.

What is an Asset-Based Lending Audit?

An asset-based lending (ABL) audit is a critical component of securing a loan backed by your company’s assets. Instead of relying on credit scores or historical earnings, ABL audits evaluate the quality and value of tangible and intangible assets used as collateral. This audit is often conducted during the underwriting or due diligence process when looking for working capital or as part of ongoing loan monitoring.

Typical Collateral Used in ABL Financing:

- Accounts Receivable (AR): Verified outstanding invoices.

- Inventory: Raw materials, finished goods, or work-in-process items.

- Equipment: Valuable machinery, tools, and vehicles.

- Real Estate: Commercial or industrial properties.

- Intellectual Property (IP): Patents, trademarks, and software (in some cases).

ABL financing is especially useful for companies that have broken covenants with their bank or experience inconsistent cash flow, making it a popular option for manufacturers, distributors, and seasonal businesses.

Why Asset-Based Lending Audits Are Crucial

ABL audits are designed to give lenders a clear picture of your borrowing base and asset health. A thorough audit reduces risk and allows for appropriate loan structuring.

Advantages of an ABL Audit:

- More Access to Capital: Uncovers underutilized assets that can enhance borrowing limits.

- Risk Mitigation: Highlights potential red flags before they affect funding.

- Process Efficiency: Encourages better record-keeping and operational oversight.

- Transparency: Builds stronger lender relationships by fostering trust.

A clean, well-documented audit can be the key to faster funding, better terms, and larger credit lines.

Step-by-Step: The ABL Audit Process

- Pre-Audit Preparation

- Organize current AR aging reports and inventory lists.

- Compile recent financial statements.

- Review customer credit limits and collection cycles.

- Field Examination

- Auditors visit your business to physically verify collateral.

- Interviews are conducted with finance and operations staff.

- Detailed walk-through of inventory and asset locations.

- Asset Evaluation

- AR Review: Validate balances, assess agings, and analyze dilution trends.

- Inventory Assessment: Check condition, turnover, valuation, and obsolescence.

- Equipment Review: Document age, condition, and appraised value.

- Audit Reporting

- Compilation of eligible and ineligible assets.

- Summary of risks and suggested action items.

- Preliminary borrowing base calculation.

- Post-Audit Loan Structuring

- Loan terms may be adjusted based on audit findings.

- May trigger follow-up audits quarterly, semi-annually, or annually.

- Lenders may recommend improvements for future audits.

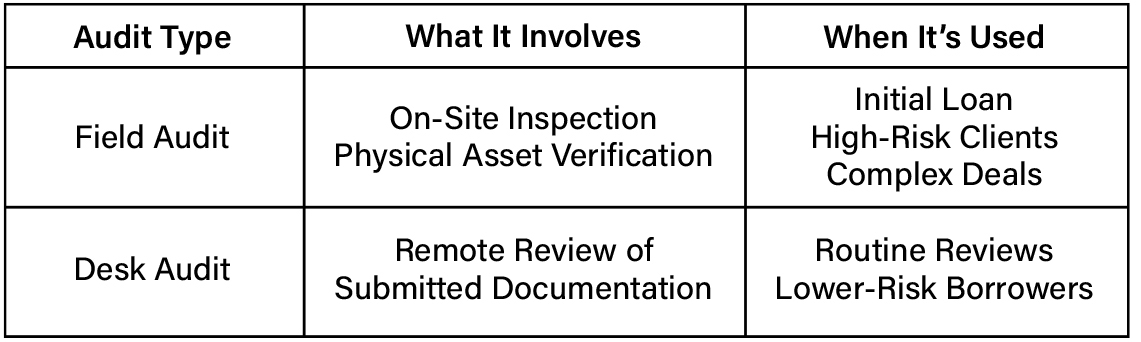

Field Audits vs. Desk Audits: What’s the Difference?

Preparing for an ABL Audit Like a Pro

Preparation is key to a successful audit. Here’s how to be ready:

Audit Preparation Checklist:

- Up-to-Date Financial Records: Ensure real-time AR and inventory data.

- AR Management: Limit invoices over 90 days and minimize customer concentration.

- Inventory Accuracy: Remove obsolete stock and ensure physical inventory matches records.

- Digital Systems: Leverage accounting platforms for fast, accurate reporting.

These steps not only help during the audit but also improve overall business efficiency and lender confidence.

Frequently Asked Questions About ABL Audits

Q: How long does an asset-based audit take?

A: Typically, 2–5 business days, depending on business complexity and preparation.

Q: Who pays for the ABL audit?

A: The borrower usually pays the cost, either upfront or as part of the loan fees.

Q: How often are audits performed?

A: Quarterly or semi-annually initially; can reduce to annual or desk audits over time.

Q: What if some assets are ineligible?

A: Those assets are excluded from the borrowing base but may be improved or replaced.

Q: Can ABL audits affect my loan terms?

A: Yes. Strong audit results may lead to better rates or expanded credit lines.

Turning Audits into Drivers for Growth

ABL audits don’t just verify your borrowing power—they can become strategic business tools.

Use Audits to:

- Upgrade Systems: Incorporate tools for better asset tracking.

- Clean-Up AR: Reduce aging receivables and diversify your customer base.

- Optimize Inventory: Eliminate slow-moving SKUs and improve turnover.

- Strengthen Lender Relations: Build trust through transparency and consistent reporting.

Conclusion: ABL Audits as a Competitive Advantage

ABL financing is a great fit for businesses in transition or expansion mode that need a funding solution tied directly to their asset base.

An asset-based lending audit is more than a financing hurdle; it’s a window into the financial health and scalability of your business. By understanding the process and preparing effectively, you and your company can:

- Access capital faster and more efficiently.

- Enhance internal controls and processes.

- Position yourself as a creditworthy borrower.

For growth-focused or asset-heavy businesses, ABL audits are a powerful step toward long-term success and financial flexibility.

About Celtic Capital

Companies looking for working capital to cover operating expenses, fund growth, increase buying power, and take advantage of vendor discounts and rebates turn to Celtic Capital. With an appetite for the more complex transactions, Celtic Capital has a history of success in crafting creative, flexible asset-based financing solutions from $500,000 to $8 million with no financial covenants.

As an independent lender, working with companies nationwide, Celtic Capital is willing and able to alter price and deal structure and expand lines of credit to handle its clients’ increased revenues; and when cash flow is an issue, will look toward providing an inventory facility to help offset lost cash flow.

If you know of, or are, a business in need of non-traditional financing, contact Mark Hafner at 800.742.0733 or mhafner@celticcapital.com, or visit us at celticcapital.com.