Asset-Based Lending (ABL): A Strategic Tool for Short-Term Liquidity and Long-Term Growth

Jun 16, 2025, 6 Minute(s) ReadIn today’s fast-paced business environment, companies must find innovative ways to ensure they have the working capital needed to stay competitive. Traditional bank loans, while offering favorable interest rates, often come with stringent eligibility criteria and lengthy approval processes. This can be a significant challenge for businesses with inconsistent cash flow, limited credit history, or those needing quick access to capital.

ABL is a powerful alternative that enables businesses to leverage their assets such as accounts receivable, inventory, machinery, or real estate as collateral to obtain financing. Unlike traditional financing, ABL focuses more on the value and liquidity of business assets rather than credit score or profitability, providing an accessible and flexible solution for businesses at any stage of growth.

The primary advantage of ABL is that it allows businesses with fluctuating cash flows or limited credit histories to secure financing by leveraging their existing assets. This type of financing can be beneficial for distributors, manufacturers, wholesalers, and service providers.

Key Features of Asset-Based Lending (ABL)

1. Collateral-Driven Financing

Unlike traditional loans, where approval depends heavily on the borrower’s creditworthiness, ABL decisions are based on the value and liquidity of collateral. This makes ABL ideal for businesses in capital-intensive industries.

2. Flexible Loan Terms

ABL provides flexibility in how loans are structured, such as revolving lines of credit or term loans tied to specific assets. This allows businesses to tailor their financing to their unique needs.

3. Fast Access to Capital

Since ABL is secured by tangible assets, the approval process is quicker than traditional bank loans. This enables businesses to access capital rapidly during times of urgency.

4. Scalable Financing

As a company’s assets grow, so does its borrowing capacity. This scalability makes ABL an excellent choice for growing businesses looking to expand without relying on traditional forms of financing.

5. Competitive Interest Rates

Although interest rates for ABL are typically higher than traditional bank loans, they are often lower than other forms of short-term financing, like merchant cash advances or unsecured loans.

The Strategic Role of Asset-Based Lending (ABL) in Business Financing

ABL is an excellent solution for businesses that need short-term funding to manage cash flow gaps, purchase inventory for peak seasons, or cover unexpected expenses. Typical use cases include:

- Working capital during periods of volatility.

- Funding inventory purchases for high-demand periods.

- Covering receivables growth or cash flow gaps.

- Emergency liquidity needs and debt restructuring.

While ABL is often used for short-term financing, it can also help businesses build a more stable financial foundation that prepares them for long-term success.

How Asset-Based Lending (ABL) Bridges the Gap to Traditional Bank Financing

ABL is often referred to as a “stepping stone” to traditional bank financing. Here’s how ABL supports this transition:

1. Establishing a Reliable Financial Track Record

ABL provides immediate liquidity, allowing businesses to meet operational expenses, service debt consistently, and maintain vendor relationships. These improvements contribute to a stronger financial history, which is an essential factor in qualifying for conventional loans.

2. Improving Financial Ratios and Creditworthiness

Using ABL to pay down high-interest obligations and improve cash flow positions businesses to enhance their balance sheets. Better debt-to-equity ratios, improved working capital, and timely financial reporting all help strengthen a company’s credit profile.

3. Encouraging Operational Discipline

Many ABL facilities require ongoing audits, borrowing base certificates, and financial reporting. This encourages tighter financial controls, better inventory and receivables management, and overall transparency, which are all key criteria banks consider when evaluating loan applications.

4. Signaling Responsible Debt Management

Successfully managing an ABL facility by making timely payments, staying within borrowing limits, and efficiently utilizing funds demonstrates a company’s ability to handle structured financing responsibly. This builds trust with traditional lenders and increases the likelihood of approval for long-term loans.

5. Facilitating Long-Term Planning

While ABL is designed for short-term or seasonal needs, it enables companies to stabilize their financial operations and focus on strategic planning. With enhanced stability, businesses can begin preparing documentation, forecasts, and financial packages suitable for long-term financing discussions with banks.

Benefits of Asset-Based Lending

- Improved Liquidity: Quickly access funds tied up in receivables, inventory or equipment.

- Accessibility: Businesses with less-than-perfect credit can still qualify for ABL.

- Ownership Retention: ABL allows business owners to retain control, unlike equity financing options.

- Financial Flexibility: Use funds for payroll, vendor payments, inventory, or business expansion.

- Reduced Risk for Lenders: Since ABL is collateralized, lenders face less risk, often translating into more favorable terms for borrowers.

Industry-Specific Use Cases for Asset-Based Lending

1. Manufacturing

Manufacturers often use ABL to finance raw materials, machinery, and equipment. This ensures they can maintain smooth production schedules without worrying about cash flow gaps.

2. Wholesale and Distribution

In wholesale and distribution, ABL helps businesses manage large volumes of unsold inventory by converting stock into working capital. This is crucial for maintaining a steady supply chain and meeting demand.

3. Service Companies

For service companies, ABL helps cover payroll while waiting for client payments using those receivables as collateral. This is vital to keep operations running smoothly.

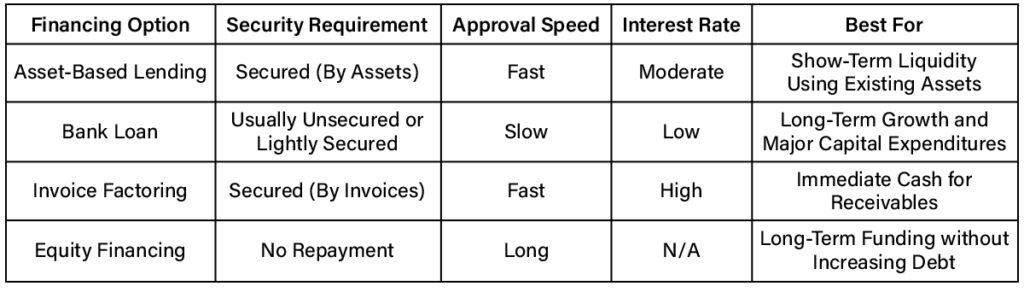

Asset-Based Lending vs. Other Business Financing Options

When Should Businesses Transition from Asset-Based Lending (ABL) to Traditional Financing?

While ABL is an excellent short-term solution, businesses should consider transitioning to traditional financing when they:

- Maintain consistent cash flow and profitability.

- Show strong financial performance over multiple quarters.

- Have less frequent reliance on asset-based borrowing.

Conclusion: The Value of Asset-Based Lending (ABL) for Business Growth

ABL is a strategic tool that offers businesses the flexibility and liquidity they need to maintain operations, fund growth, and weather financial challenges. By understanding how ABL works and its benefits, businesses can use it to build a more stable financial foundation and eventually move toward traditional, lower-cost financing options.

If you’re looking for a flexible and accessible financing solution, contact Celtic Capital and explore how your business assets can open the door to working capital and future growth.

About Celtic Capital

Companies looking for working capital to cover operating expenses, fund growth, increase buying power, and take advantage of vendor discounts and rebates turn to Celtic Capital. With an appetite for more complex transactions, Celtic Capital has a history of success in crafting creative, flexible asset-based financing solutions from $500,000 to $8 million with no financial covenants.

As an independent lender, working with companies nationwide, Celtic Capital is willing and able to alter price and deal structure and expand lines of credit to handle its clients’ increased revenues; and when cash flow is an issue, will look toward providing an inventory facility to help offset lost cash flow.

If you know of, or are, a business in need of non-traditional financing, contact Mark Hafner at 800.742.0733 or mhafner@celticcapital.com, or visit us at celticcapital.com.